How Much Do Brokers Charge To Sell A Business? Your Questions Answered

You may think selling your business would be a straightforward thing to do. You’ve built a brilliant enterprise, surely someone will snatch your hands off for it? The reality is, business sales can be complex.

Depending on the size and structure of your company, there’s a lot to consider. It’s why many people turn to brokers. But when you add this third-party into the mix, there’s one question you no doubt want to know the answer to: how much do brokers charge to sell a business?

Below, you can find the answer. We explore how brokers can structure their fees, what kind of prices you can expect, and what factors can influence the final total.

Let’s dive in and answer the all-important question.

How Much Do Brokers Charge To Sell A Business On Average?

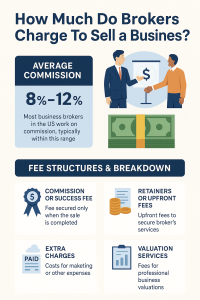

In the US, business brokers tend to work on commission. This usually works out as a percentage of the final sale price. On average, this figure ranges between 8% and 12%, though it can vary depending on the size of the business and the complexities involved.

Most brokers work on something known as the modified Lehman formula, or sliding scale. This means that, generally speaking, the greater the sale value, the lower the fee charged. Here are some examples:

-

- Businesses under $1 million – Expect to pay 10%–12%

- Businesses between $1m–$5m – Around 8%–10%

- Businesses above $5m – Typically 2%–6%, often negotiable

There are different ways that you can structure your deal, however, such as agreeing fixed fees, paying for retainers, and also working on hourly rates. Let’s take a look at the different types of fee structures common in business sales.

Fee Structures and Breakdown

Here’s a breakdown of some of the most common fee structures used for business sales:

-

- Commission or Success Fee – this is perhaps the most common, with the fee secured only when the sale is completed. This means the pressure is on the broker to ensure the sale is completed. Given the risk involved on the part of the broker (investing time for potentially no money), the commission fee can be as high as 12% or even higher, as set out above.

- Retainers or Upfront Fees – to secure the services of the broker, you may have to pay a fee upfront. This fee could vary depending on the broker, but expect to pay anywhere between $2,000 and $20,000 depending on the task at hand.

- As well as being charged a commission, you may incur extra charges for the likes of marketing. For example, if the broker needs to list the business for sale in directories, this may come at a cost that they may pass on to you. Fees could range between $500 and $5,000. However, many brokers include these costs within commissions.

- Valuation Services – in order to gain a true market value for your business, a broker may opt for the services of a professional valuer. This may come at a cost of between $1,000 and $5,000 which they may pass onto you. However, it could also be included in the commission, so always check with the broker to see if you can structure this in a way that benefits you most.

Why Do They Charge A Fee?

Many people grow annoyed with middle-men like brokers. They may feel that they don’t do much to help facilitate the sale, at least not enough to justify the high fees they charge. However, it’s important to be aware of the role brokers play and why they charge the fees that they do.

For example, one of the main benefits you get with working with a business broker is that you gain access to their expertise and their network of contacts. They may know wealthy individuals looking for certain types of businesses to buy. This can especially be the case with brokers who focus on a specific industry.

A broker can also help value your business accurately and then present it in the best way possible. This means you get the right offer you deserve.

Brokers should also handle a lot of the paperwork, which can be complex and overwhelming if you’re not familiar with it. For example, it’s vital that paperwork, escrow, and ownership transfer are completed properly, otherwise the sale could fall through.

In short, a good broker acts as project manager, advisor, and negotiator all in one. Their goal is not just to sell your business—but to get the best possible deal, and that’s why they charge the fees that they do.

Why Use A Broker To Sell A Business?

We’ve alluded to some of the benefits of using a broker to sell your business. Here’s a handy overview, along with some other perks to going down this route:

-

- Helpful if you’re short on time – Selling a business is time-consuming. Brokers take on the workload so you can focus on running your company, which can be time-sapping enough, especially if you have to make preparations for the sale.

- Great if you want a better price – Brokers know how to value your business with accuracy, position it in the market, and generate buyer competition.

- Useful if you need confidentiality – They know how to market your business without alerting staff, vendors, or customers, which can help avoid major disruption.

- Reassuring if you’re unfamiliar with the process – Brokers understand deal structures, legal documents, and negotiations. That expertise is critical to avoiding costly mistakes.

If you’re trying to get the best price possible and you’re not sure how to sell a business, the support a broker offers can outweigh the cost, even for a commission as high as 10%.

This infographic breaks it all down quite nicely:

What Types Of Businesses Can Brokers Help You Sell?

One of the perks to working with a broker is that they’re often capable of selling any type of business. There are, of course, some brokers who specialize in different industries, but generally, most brokers can handle a range of business types. Here’s a breakdown of some of the most common:

-

- Main Street businesses (like restaurants, dry cleaners, salons)

- Franchises

- Professional services firms (like marketing agencies and law firms)

- E-commerce businesses

- Manufacturing companies

- Medical and dental practices

- Logistics and transport businesses

- Construction and trade services

- Software and SaaS companies

If you opt to work with a broker, make sure they’re familiar with sales of your business type. You may, for instance, operate in a niche with regulations and rules that you need to comply with. If they’re not familiar with those, they could make errors which could impact the sale.

Let’s take a look at some other important considerations to make when selecting a broker.

How Do I Know Which Broker Is The Best For Me?

We mentioned one important consideration when selecting a broker: experience and knowledge of your business type. What other factors should you consider when selecting a broker? Let’s take a look:

-

- Track Record – you want to work with someone with a solid track record in achieving good prices for businesses and closing deals smoothly. You can usually identify this through customer testimonials and reviews. Just make sure they’re independently made.

- Licensing and Credentials – business brokerage is a complex field. Ensuring your broker is suitably qualified is vital. Not all states require business brokers to be licensed, but many reputable brokers belong to associations like the International Business Brokers Association (IBBA) or hold Certified Business Intermediary (CBI) credentials

- Transparent Fees – it’s important that your broker is honest and open about the fees they charge. The last thing you want is a sudden change midway through.

- Network – in order to secure a fast sale, a broker with a large network of clients will likely do a better job of finding a buyer than a new broker who needs to put out an advert to drum up interest.

- Communication Skills – selling your business can be like letting go of your baby. You want to ensure that it’s in good hands, so a broker who communicates well and in a manner that you appreciate can be vital.

To help ensure that you find the best broker, you could meet with 2 or 3 different ones, perhaps more, and go with the most impressive.

How Long Does It Take For A Broker To Complete A Sale?

It’s important to remember that each business sale is unique. Different factors can influence the length of time it takes to complete the sale. As a general rule, you can look at the valuation of a business to assess the complexity. With this in mind, here’s a helpful breakdown to give you an idea:

The timeline to sell a business varies, but here’s what you can generally expect:

-

- Small businesses ($100K–$1m in revenue) – 3 to 9 months

- Mid-sized businesses ($1m–$5m) – 6 to 12 months

- Larger deals ($5m+) – 9 to 18 months or longer

This is just a guideline. Different factors can impact these durations. For example, a growing business with a strong performance record is sometimes more likely to sell faster than a start-up with limited cash flow.

Sometimes, finding a buyer can be the longest delay. Demand for certain businesses may just be low. For example, the sector may be experiencing a downturn or prospects may be low for the future, which makes it a less appealing option.

Key Takeaways

-

- So, how much do brokers charge to sell a business? Most charge a success-based commission ranging from 8% to 12%, with minimum fees or upfront costs possible depending on the broker and deal size.

- Brokers earn their fee by handling everything from valuation to buyer screening, negotiations, and closing—saving you time and reducing risk.

- Working with a broker can increase your chances of selling faster, at a higher price, and with fewer headaches.

- Always vet brokers thoroughly—experience, transparency, and a strong network matter. It can help lead to a faster sale!

Keep up with Business Rout to learn more about business growth and insights to help you start and grow a business.